Your reps are winging it. Some qualify deals differently. Others skip discovery entirely and jump straight to demos. A few chase every lead regardless of fit, burning windshield time on accounts that’ll never close.

Teams using a defined sales methodology close deals at significantly higher rates than those without one—companies with structured sales processes see win rates increase by approximately 8% compared to ad-hoc approaches. The difference isn’t talent—it’s structure. A methodology gives your team a repeatable playbook for moving prospects from first contact to signed contract, with clear criteria for what to do at each stage.

This guide covers the top B2B sales methodologies, how to choose the right one for your team, and—critically—how to apply these frameworks to field sales where territory management, route planning, and face-to-face selling create unique challenges.

What Is a Sales Methodology?

A sales methodology is the “how” behind your sales process. Your sales process defines the stages a deal moves through (prospecting, discovery, proposal, close). Your methodology defines how reps actually work those stages—what questions to ask, which qualification criteria matter, and how to handle objections.

Think of it this way: Your process is the map. Your methodology is the driving instructions. Without methodology, reps improvise at every turn, creating inconsistent results and unreliable forecasts.

The best methodologies provide frameworks for discovery, qualification, objection handling, and deal progression. They make your best rep’s instincts teachable and scalable across your entire team.

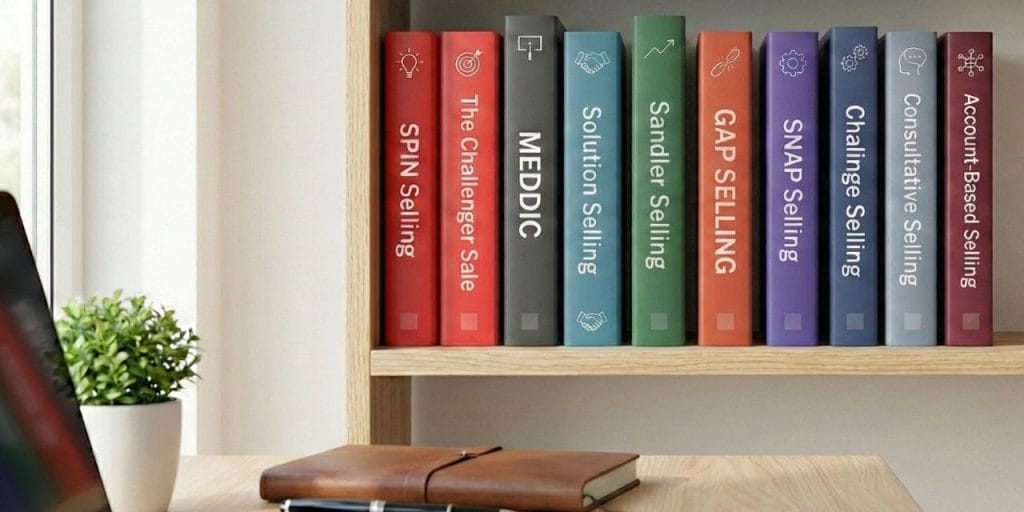

Top B2B Sales Methodologies Explained

Here are the proven methodologies that work for complex B2B sales, with context for how field sales teams apply them in territories.

SPIN Selling

SPIN Selling uses a question-based framework to guide discovery conversations through four stages: Situation (understand the current state), Problem (identify pain points), Implication (explore consequences of inaction), and Need-Payoff (help prospects articulate the value of solving their problem). Developed by Neil Rackham and his team at Huthwaite, the methodology is based on research analyzing more than 35,000 sales calls made by 10,000 salespeople in 23 countries over 12 years.

Best for: Complex B2B sales requiring deep discovery, especially in industries where buyers don’t fully understand their own problems yet.

Field sales application: SPIN works exceptionally well during on-site visits where you have extended face time. Use Situation and Problem questions early in territory prospecting, then schedule follow-up visits for Implication and Need-Payoff conversations once you’ve identified qualified pain.

MEDDIC

MEDDIC is an enterprise qualification framework: Metrics (quantifiable business impact), Economic Buyer (who controls budget), Decision Criteria (how they’ll evaluate solutions), Decision Process (steps and timeline), Identify Pain (business problem), and Champion (internal advocate). Companies that implement MEDDIC rigorously see win rates climb 20-30% compared to traditional sales methods.

Best for: Large, complex deals with multiple stakeholders, long sales cycles, and enterprise budgets. Particularly effective for teams selling into accounts with formal procurement processes.

Field sales application: Use MEDDIC criteria to prioritize which accounts in your territory warrant regular field visits. Map your territory by MEDDIC qualification—concentrate travel on accounts where you’ve identified the economic buyer and have a champion, not on prospects who can’t articulate metrics or decision criteria.

The Challenger Sale

The Challenger methodology follows a Teach, Tailor, Take Control approach. Reps teach prospects something new about their business, tailor the message to specific pain points, and take control of the sales conversation rather than responding to buyer demands. Research shows that 40% of high-performing sales reps primarily use a Challenger style, compared to just 7% who take a Relationship Builder approach.

Best for: Situations where buyers need to think differently about their problems, or when you’re competing against the status quo rather than other vendors.

Field sales application: Reserve Challenger conversations for executive-level visits in your territory. The “Teach” component requires credibility and relationship capital that face-to-face meetings build better than phone calls. Use territory planning to cluster C-level meetings where you can deliver high-impact, insight-driven conversations.

Solution Selling

Solution Selling focuses on diagnosing specific business problems before prescribing solutions. Reps ask diagnostic questions, document pain points, quantify impact, and position their product as the remedy to the diagnosed problem.

Best for: Clearly defined customer pain points where your product solves a specific, measurable business challenge. Works well in industries with established pain points (inefficiency, compliance risk, revenue loss).

Field sales application: Solution Selling pairs naturally with territory-based account planning. Document pain diagnostics during discovery visits, then use that data to customize proposals for follow-up meetings.

Sandler Selling

The Sandler method emphasizes upfront contracts, mutual respect, and rigorous qualification. Reps establish clear expectations at the start of every conversation, qualify budget and decision authority early, and walk away from poor-fit opportunities.

Best for: Relationship-driven B2B sales where trust and long-term partnerships matter more than transactional speed. Effective for reps who hate feeling pushy.

Field sales application: Sandler’s “upfront contract” approach works well when scheduling territory visits—set clear agendas and qualification criteria before driving to accounts. This prevents wasted travel on prospects who aren’t serious.

Gap Selling

Gap Selling identifies the gap between a prospect’s current state and their desired future state, then positions your solution as the bridge. The methodology focuses on change creation—making prospects see that staying put is more painful than buying.

Best for: Change-resistant buyers who need urgency, or markets where prospects are comfortable with inadequate solutions.

Field sales application: Use Gap Selling when territory planning reveals stagnant accounts that haven’t engaged in months. Schedule visits specifically to challenge their status quo and create urgency around closing the gap.

SNAP Selling

SNAP stands for Simple, iNvaluable, Aligned, Priority. The methodology helps reps break through to overwhelmed buyers by keeping messaging simple, demonstrating unique value, aligning with business priorities, and respecting that your solution must be a top-three priority to get bought.

Best for: High-velocity sales cycles with busy buyers who receive dozens of pitches weekly. Works in markets where buyers are overwhelmed with options.

Field sales application: SNAP’s simplicity principle matters when planning territory coverage. Streamline your messaging for quick wins rather than overcomplicating multi-touch campaigns. Target accounts where you can be a top-three priority based on timing and fit.

Consultative Selling

Consultative Selling positions reps as trusted advisors rather than product pushers. Reps invest time understanding the business, provide strategic recommendations (even if they don’t lead directly to sales), and build long-term relationships based on expertise.

Best for: Strategic, long-term relationship sales where trust and advisory positioning drive deals more than product features.

Field sales application: Consultative Selling thrives in field environments where repeated face-to-face visits build advisory relationships. Ideal for enterprise territories with concentrated, high-value account bases where you can invest time becoming a strategic partner.

Account-Based Selling (ABS)

Account-Based Selling targets high-value accounts with hyper-personalized outreach, multi-threaded engagement across stakeholders, and coordinated campaigns. Every touchpoint is customized to the specific account’s needs, structure, and decision-making process.

Best for: Enterprise field sales targeting specific named accounts by territory. Works when you have a defined list of dream accounts rather than broad market prospecting.

Field sales application: ABS is purpose-built for territory-based selling. Map your territory by target accounts, assign ownership, and plan visits around account-specific strategies. Coordinate field visits with marketing campaigns and inside sales efforts for multi-channel account penetration.

How to Choose the Right Sales Methodology

Not all methodologies fit all teams. Choose based on your deal complexity, sales cycle, and—for field teams—territory characteristics.

Match Methodology to Deal Complexity

Transactional deals with short sales cycles favor simpler frameworks like SNAP or Solution Selling. You need speed and clarity, not elaborate qualification matrices. Consultative and enterprise deals with multiple stakeholders require robust frameworks like MEDDIC or Challenger that handle complexity.

For field sales teams, consider territory density and account concentration. High-density territories with many smaller accounts benefit from streamlined methodologies (SNAP, Solution Selling). Low-density territories with concentrated enterprise accounts justify the rigor of MEDDIC or Account-Based Selling.

Consider Your Sales Cycle Length

Short-cycle sales (under 30 days) need methodologies that move fast—SNAP, Solution Selling, or basic SPIN. Long-cycle sales (90+ days) require frameworks that maintain momentum across multiple touchpoints and stakeholders—MEDDIC, Challenger, Consultative, or Account-Based Selling.

Field sales adds a travel variable: How many in-person visits does your average deal require? If you close in 2-3 visits, prioritize methodologies with clear qualification gates (MEDDIC, Sandler) to avoid wasting trips. If you build relationships over 6+ visits, consultative and relationship-focused frameworks work better.

Assess Your Buyer’s Journey

Educated buyers who’ve researched solutions respond well to Challenger (teach them something new) or Consultative (be the expert they want). Problem-unaware prospects need SPIN (help them discover pain) or Gap Selling (create urgency around change). In fact, 68% of millennial B2B buyers prefer self-service research tools over speaking to a sales rep, and many complete up to 70% of the buying process online before engaging with a supplier.

Field sales has an advantage here: Face-to-face discovery uncovers problems that prospects don’t articulate over the phone. SPIN and Gap Selling methodologies leverage that advantage by digging deeper during on-site conversations.

Quick Decision Guide: Match Your Challenge to a Methodology

Field sales leaders: If your team faces one of these challenges consistently, start with the methodology that addresses it directly.

| If Your Primary Challenge Is… | Use This Methodology | Why It Works |

|---|---|---|

| We get ghosted after a great first meeting | Sandler Selling | Upfront contracts set clear next steps and mutual commitment before you leave the parking lot |

| Our deals get stuck in legal/procurement | MEDDIC | Decision Process criterion forces you to map the full approval chain early, not at contract stage |

| Prospects don’t see why they should change | Gap Selling or Challenger | Both create urgency by making the status quo uncomfortable—Gap quantifies the cost, Challenger reframes the problem |

| We’re losing to cheaper competitors | SPIN Selling | Implication and Need-Payoff questions build value beyond price by connecting pain to business impact |

| Reps chase unqualified accounts | MEDDIC or Sandler | Both require rigorous qualification gates that prevent wasted windshield time on poor-fit prospects |

| We can’t get past gatekeepers to executives | Challenger | Teaches reps to lead with insights that earn executive attention, not feature pitches |

Methodology Comparison Table

| Methodology | Deal Size | Sales Cycle | Field Sales Fit | Best For |

|---|---|---|---|---|

| SPIN Selling | Medium to Large | 60-120 days | Excellent | Complex discovery requiring deep problem exploration |

| MEDDIC | Large/Enterprise | 90-180+ days | Excellent | Enterprise accounts with formal procurement and multiple stakeholders |

| Challenger | Medium to Large | 60-120 days | Excellent | Executive-level conversations requiring insight and credibility |

| Solution Selling | Small to Medium | 30-90 days | Good | Defined pain points with clear product-solution fit |

| Sandler | Medium | 45-90 days | Good | Relationship-driven sales requiring upfront qualification |

| Gap Selling | Medium to Large | 60-120 days | Good | Change-resistant buyers needing urgency |

| SNAP Selling | Small to Medium | 15-60 days | Moderate | High-velocity sales to overwhelmed buyers |

| Consultative | Large/Enterprise | 90-180+ days | Excellent | Long-term strategic relationships in concentrated territories |

| Account-Based (ABS) | Enterprise | 120-240+ days | Excellent | Named account targeting with coordinated multi-touch campaigns |

Visual Tool Note: For teams who prefer visual frameworks, consider creating a Methodology Map that plots these nine methodologies on two axes: Deal Complexity (X-axis: Simple → Complex) and Relationship Depth (Y-axis: Transactional → Strategic). This quadrant diagram helps reps visualize where each methodology sits in your sales environment. For example:

- Upper Right Quadrant (Complex + Strategic): MEDDIC, Challenger, Consultative, Account-Based

- Lower Left Quadrant (Simple + Transactional): SNAP, Solution Selling

- Mixed Zones: SPIN and Sandler bridge multiple quadrants depending on application

Many field sales leaders print this map and post it in territory planning sessions to help reps select the right methodology for each account tier.

Applying Sales Methodologies to Field Sales

Most methodology guides ignore the realities of territory-based selling: travel time, route planning, and the need to prioritize which accounts get face-to-face attention. Here’s how to apply these frameworks when you’re managing territories, not just pipelines.

Territory-Based Account Qualification

Use your methodology’s qualification criteria to decide which accounts warrant field visits. With MEDDIC, only schedule on-site meetings for accounts where you’ve identified metrics, an economic buyer, and decision criteria. Don’t waste windshield time on accounts that can’t articulate business impact or decision timelines.

Map your territory by qualification stage. Cluster high-qualification accounts (those meeting 4+ MEDDIC criteria) for priority visits. Route lower-qualified accounts through phone or video until they meet your field visit threshold. This balances travel efficiency with methodology rigor—you’re not abandoning your framework to fill your calendar.

Create a qualification scorecard based on your chosen methodology and overlay it on your territory map. SPOTIO’s territory management tools let you tag accounts by qualification stage and filter by criteria like industry, company size, or engagement level, so you can visually plan routes around accounts that actually deserve face time.

Route Planning Around Methodology Stages

Don’t plan routes randomly. Cluster visits by methodology stage to maximize effectiveness. If you’re running SPIN, group early-stage accounts (Situation/Problem questions) into one route, then schedule separate trips for late-stage accounts ready for Implication and Need-Payoff conversations. The context switching is inefficient when you bounce between discovery and closing conversations all day.

For Challenger reps, batch executive-level “Teach” meetings rather than mixing them with mid-level discovery calls. These conversations require different preparation, energy, and messaging. Plan routes that let you show up fully prepared for the type of conversation each methodology stage requires.

Multi-touch methodologies like Account-Based Selling require coordinated visit sequences. Plan your territory routes to support 3-4 scheduled touchpoints per account over weeks or months, not scattershot visits whenever you’re nearby. This strategic routing reinforces your methodology rather than undermining it with opportunistic territory coverage.

Sample Weekly Field Rhythm for Methodology-Driven Territory Coverage

Don’t spread methodology stages randomly across the week. Structure your field schedule around the type of conversation each methodology requires:

Monday-Tuesday: Discovery & Prospecting Routes (SPIN/Solution Selling)

- Focus: Early-stage accounts needing problem exploration

- Methodology: SPIN Situation and Problem questions, Solution Selling diagnostics

- Route planning: Higher volume of shorter visits (6-8 accounts), cluster geographically

- Mental state: Curiosity and listening mode

- CRM logging priority: Pain points discovered, next-step commitments

Wednesday: Qualification & Assessment Routes (MEDDIC/Sandler)

- Focus: Accounts showing interest that need qualification vetting

- Methodology: MEDDIC criteria verification, Sandler budget/authority/need/timeline confirmation

- Route planning: Medium volume (4-6 accounts), prioritize accounts with 2+ MEDDIC criteria identified

- Mental state: Analytical and evaluative

- CRM logging priority: Economic buyer identified, decision criteria confirmed, champion status

Thursday-Friday: Executive & Closing Routes (Challenger/Consultative)

- Focus: Late-stage accounts and strategic relationship building

- Methodology: Challenger Teach conversations, Consultative advisory positioning

- Route planning: Lower volume of deeper meetings (3-4 accounts), schedule 60-90 min blocks

- Mental state: Strategic and insight-driven

- CRM logging priority: Challenger insights delivered, objections addressed, next milestones set

Flexible: Account-Based Selling runs continuously across all days for named accounts, with coordinated touchpoints scheduled weeks in advance.

This rhythm prevents context-switching fatigue and lets reps prepare mentally for the type of conversation each methodology demands. Adjust ratios based on your pipeline stage distribution—if you need more pipeline, shift to 3 discovery days and 2 qualification/closing days.

Tracking Methodology Execution in the Field

The best methodology means nothing if reps don’t log what happened. Field sales teams struggle with this—you’re in the car between meetings, not sitting at a desk with time to update your CRM. One-tap activity logging solves this. Log SPIN questions asked, MEDDIC criteria identified, or Challenger insights delivered immediately after meetings while details are fresh.

Location-verified activities tie methodology execution to territory coverage. Your CRM shows not just that a rep logged a discovery call, but that they were physically at the account asking SPIN Problem and Implication questions. This data drives forecast accuracy and coaching—you can see which reps skip qualification steps or rush through discovery.

Integrate methodology stages with your CRM so every logged activity maps to your framework. SPOTIO syncs field activity data seamlessly with major CRMs, ensuring methodology execution gets tracked without reps spending 30 minutes per day on data entry.

How to Run a Methodology-Based 1-on-1

The biggest coaching mistake field sales managers make: Asking “How’s the deal going?” instead of using methodology criteria to diagnose exactly where deals are stuck.

Structure your rep 1-on-1s around the methodology framework you’ve adopted. Here’s how to coach to each methodology:

MEDDIC Coaching Questions:

- “What specific Metrics have we quantified for the Smith deal? What’s the dollar impact?”

- “Have you met the Economic Buyer face-to-face, or are you still talking to influencers?”

- “Walk me through their Decision Process—who signs, in what order, and what’s their timeline?”

- “Who’s our Champion? Have they confirmed they’ll advocate for us internally?”

SPIN Coaching Questions:

- “What Problem did you uncover during your last visit? How did the prospect describe it?”

- “Did you ask Implication questions? What consequences of inaction did they acknowledge?”

- “What Need-Payoff did they articulate? Did they tell you the value of solving this, or did you tell them?”

Challenger Coaching Questions:

- “What insight did you Teach during your executive meeting? Was it about their business or about your product?”

- “How did you Tailor that insight to their specific situation?”

- “Where did you Take Control—did you push back on their timeline, budget, or evaluation criteria?”

Sandler Coaching Questions:

- “What was your Upfront Contract going into that meeting? Did you get agreement on next steps?”

- “Did you qualify Budget and Authority early, or are we still guessing?”

- “When did you confirm this is a Priority for them? What evidence do you have?”

Instead of reviewing every deal, spot-check 2-3 deals per 1-on-1 using these methodology-specific questions. You’ll instantly see whether reps are executing the framework or just checking boxes. Coach to the methodology principles, not the deal details—that’s how you scale best practices across your entire team.

Blending Sales Methodologies for Field Sales

You’re not locked into one methodology. The best field teams blend frameworks to match different territory scenarios. Here’s how to combine methodologies strategically.

SPIN for Discovery + MEDDIC for Qualification

Use SPIN’s question framework during initial territory prospecting to uncover pain and business impact. Once a prospect shows interest, shift to MEDDIC qualification to determine if they’re worth ongoing field investment. SPIN gets conversations started; MEDDIC decides who gets continued attention.

This blend works exceptionally well for field teams because SPIN maximizes the discovery advantage of face-to-face meetings, while MEDDIC prevents you from wasting travel on unqualified accounts. Run SPIN conversations during first visits, then score accounts on MEDDIC criteria before scheduling follow-ups.

Transition explicitly between frameworks in your sales process. Train reps to recognize when they’ve gathered enough SPIN data (Situation, Problem, Implication, Need-Payoff) to start asking MEDDIC questions (Metrics, Economic Buyer, Decision Criteria). Don’t let reps skip qualification just because they uncovered pain.

Challenger + Solution Selling for Complex Territories

Use Challenger methodology (Teach, Tailor, Take Control) for executive-level conversations, then shift to Solution Selling for mid-level stakeholders who need detailed pain diagnosis and product mapping. Executives respond to insights and strategic framing; operational buyers need tactical solutions to specific problems.

This hybrid approach matches methodology to stakeholder level within the same account. Plan territory visits that hit both levels—start with a Challenger conversation at the C-suite to create strategic urgency, then follow with Solution Selling workshops for directors and managers who’ll implement your product.

The key is consistency in messaging: Your Challenger insight and your Solution Selling pain diagnosis must align. If you teach the CEO that their problem is X, your solution presentation to the VP of Operations better diagnose X with specificity and data.

Consultative Selling + Account-Based Strategies

Combine Consultative Selling’s advisory positioning with Account-Based Selling’s targeted account focus for enterprise territories. Invest deeply in 10-20 strategic accounts, building trusted advisor relationships through repeated visits, strategic recommendations, and long-term partnership.

This blend works best in concentrated territories where you have a defined list of dream accounts. Apply consultative principles (provide value before asking for the sale, invest in understanding their business, offer strategic insights) with ABS tactics (multi-threaded engagement, personalized campaigns, coordinated field and marketing touchpoints).

Field sales teams excel at this hybrid because face-to-face visits build advisory credibility faster than phone or email. Schedule quarterly business reviews with key accounts even when there’s no active deal—that’s consultative relationship-building with account-based strategic focus.

Common Mistakes When Using Sales Methodologies

Even good methodologies fail when teams misapply them. Here’s what goes wrong in field sales environments.

Treating It as a Checklist

Methodologies provide frameworks, not scripts. Reps who rigidly follow every step regardless of context kill deals. If a prospect volunteers their budget and decision process in the first meeting, don’t robotically march through 10 more qualification questions because your MEDDIC checklist says so.

Field sales requires reading the room—literally. You’re sitting across from prospects, reading body language and energy. Good reps adapt methodology to conversation flow rather than forcing conversations into methodology templates. The framework guides you; it doesn’t own you.

Train reps on the principles behind each methodology step so they understand why they’re asking questions, not just what to ask. Principle-based understanding creates flexibility; checklist compliance creates robotic selling.

Skipping Qualification to Fill Your Route

Field sales teams face unique pressure: You’ve driven two hours to hit accounts in a territory, so you’re tempted to schedule visits with anyone who’ll take a meeting. This undermines methodology-based qualification. You end up presenting to unqualified prospects just to justify the trip.

Fix this with territory planning discipline. Use your methodology’s qualification criteria before scheduling visits, not after. If an account doesn’t meet minimum MEDDIC or Sandler standards, route them to phone or video qualification first. Only schedule field visits for accounts that clear your qualification bar.

This requires saying no to meetings and accepting that some routes will have fewer stops. That’s better than burning time and fuel on prospects who’ll never buy. Track qualification-to-close rates by territory to prove this discipline pays off.

Not Logging Methodology Data Consistently

CRM gaps kill forecast accuracy. Reps who don’t log which SPIN questions they asked, which MEDDIC criteria they’ve confirmed, or which Challenger insights they delivered create black holes in your pipeline visibility. Managers can’t coach what they can’t see.

Field reps are especially prone to logging gaps because they’re in the car between meetings. One-tap activity logging solves this—log the methodology stage and key insights immediately after each visit while you’re still in the parking lot. Location-verified logging proves reps actually had the conversations they’re claiming.

Make methodology data fields required in your CRM for deals above a certain size. If it’s a qualified enterprise opportunity, reps must document MEDDIC criteria or SPIN stages before the deal advances. This creates accountability without micromanaging.

Frequently Asked Questions

What is the best sales methodology for B2B?

There’s no single “best” B2B sales methodology—it depends on your deal complexity, sales cycle, and buyer characteristics. MEDDIC works best for enterprise deals with formal procurement, while SPIN Selling excels in complex sales requiring deep discovery. Smaller deals with shorter cycles benefit from SNAP or Solution Selling. Choose based on what you sell and how your buyers buy, not what’s trendy.

What’s the difference between SPIN selling and MEDDIC?

SPIN Selling is a discovery methodology focused on asking the right questions to uncover pain and build need. MEDDIC is a qualification framework focused on determining if a deal is winnable based on metrics, decision criteria, economic buyer access, and champion support. SPIN tells you how to conduct discovery conversations; MEDDIC tells you which opportunities to pursue. Many teams use both: SPIN for discovery, MEDDIC for qualification.

Can you use multiple sales methodologies together?

Yes, and the best teams often do. Common combinations include SPIN for discovery + MEDDIC for qualification, Challenger for executive engagement + Solution Selling for operational stakeholders, or Consultative Selling + Account-Based strategies for enterprise territories. The key is defining when to use each methodology—by deal stage, stakeholder level, or account tier—so reps know which framework applies in each situation.

Which sales methodology is best for field sales teams?

Methodologies that emphasize relationship-building and qualification work best for field sales: SPIN, MEDDIC, Challenger, Consultative Selling, and Account-Based Selling. These frameworks leverage the advantage of face-to-face meetings for deeper discovery and relationship development. Avoid methodologies designed for high-velocity, low-touch sales (like SNAP) unless your field team sells transactional products with short cycles.

How do I apply sales methodologies to territory management?

Use your methodology’s qualification criteria to prioritize which accounts get field visits. Map accounts by methodology stage (discovery vs. qualification vs. closing) and cluster visits accordingly. For example, with MEDDIC, only schedule on-site meetings for accounts where you’ve identified the economic buyer and decision criteria. This prevents wasted travel on unqualified prospects while maintaining methodology rigor.

Do sales methodologies work for outside sales?

Absolutely. Methodologies are even more critical for outside sales because travel time and territory coverage create constraints. You can’t visit every prospect, so methodology-based qualification helps you prioritize windshield time on accounts that fit your framework. Field sales teams also benefit from methodologies that leverage face-to-face advantages—deep discovery (SPIN), relationship-building (Consultative), and executive access (Challenger).

How long does it take to see results from a sales methodology?

Most teams see measurable improvement in win rates and forecast accuracy within 60-90 days of consistent methodology adoption. Companies implementing structured sales processes and optimization see an average 15% improvement in overall win rate within 90 days. However, initial results often dip during the first 30 days as reps adjust to new qualification standards and disqualify weak opportunities they would have chased previously. The short-term pipeline shrink is worth it—you’ll close more of what remains and forecast more accurately.

Pick Your Framework and Commit

Sales methodologies work when teams commit to a framework and execute it consistently across territories. Organizations with sales methodology adoption rates above 75% see above-average gains in revenue plan attainment, quota attainment, and win rates—with significant boosts at adoption rates greater than 90%. Don’t methodology-hop every quarter or let reps pick their favorite framework individually. Choose the methodology that matches your deal complexity, sales cycle, and territory structure, then train your team to execute it with discipline.

SPOTIO helps field sales teams execute methodologies like MEDDIC and SPIN through territory-based workflows, location-verified activities, and one-tap logging. Filter accounts by qualification criteria, optimize routes around methodology stages, and sync field data to your CRM—all from a mobile-first platform built specifically for outside sales teams.