Lobel Financial Achieves 4x Growth in 8 Months with SPOTIO

Lobel Financial, a 45-year consumer finance company, transformed their underutilized field sales system to quadruple loan applications within 8 months. With no way to verify dealer visits across 50+ field reps and fragmented territory management, SPOTIO’s territory optimization and GPS tracking delivered the unified visibility needed to dominate indirect lending.

Who They Are

Founded in 1978 and headquartered in Anaheim, California, Lobel Financial is a privately held consumer finance company that serves franchise and independent auto dealerships across multiple states. The company provides financing solutions for borrowers across the entire credit spectrum from prime to sub-prime, operating in the competitive indirect lending space where consistent dealer engagement and relationship-building drive success.

The Challenge

Lobel Financial faced critical operational barriers that hindered their field sales effectiveness across dealer territories:

- Zero field sales visibility – No way to verify whether representatives actually visited claimed dealer locations, operating purely on trust

- Fragmented territory management – Sales reps often assigned far from dealer clusters without analytical territory optimization

- Absence of performance analytics – No comprehensive reporting to track KPIs, set goals, or implement systematic coaching programs

Their existing Salesforce implementation was “underutilized and as broken as it could be,” creating blind spots that prevented correlation between activities and results.

The Solution

Lobel Financial partnered with SPOTIO and Squaro consultancy to:

- Deploy data-driven territory redesign using advanced analytics to identify optimal dealer clusters and geographic efficiency

- Activate GPS-enabled visit verification with custom 1,500-foot accuracy parameters ensuring 95%+ visit tracking

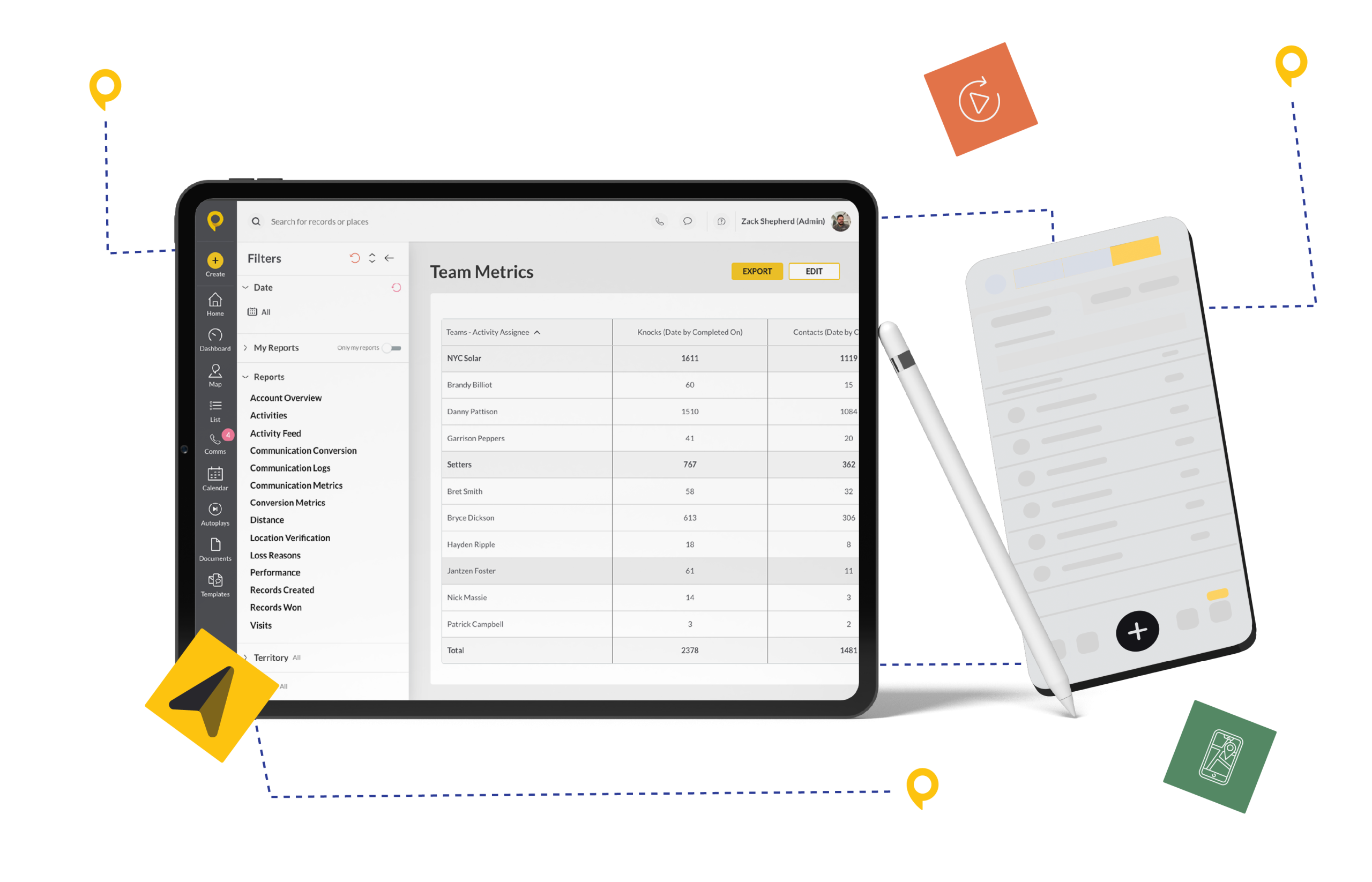

- Build comprehensive performance dashboards providing real-time visibility into individual and team metrics

- Implement mobile-first field capabilities enabling seamless dealer interaction logging and territory management

The Result

SPOTIO delivered unprecedented transformation for Lobel Financial’s lending operations within 8 months:

- 4x increase in loan application volume – Quadrupled their pipeline through optimized field activities and dealer engagement

- 1,500-foot verification accuracy – Custom GPS parameters ensure 95%+ visit accuracy for reliable performance tracking

- 50+ user deployment success – Seamless transition of entire field sales team to unified platform with responsive support

- Territory-based goal achievement – Automated commission calculations tied to performance drove accountability and results

The transformation positioned Lobel Financial to compete aggressively in indirect lending while maintaining the dealer relationships critical for sustained growth in consumer finance ⚡

For Lobel Financial, SPOTIO became the catalyst that transformed 45 years of traditional lending operations into a modern, data-driven field sales machine. By replacing fragmented processes with systematic visibility and territory optimization, they gained the competitive advantage needed to maximize every dealer relationship and drive unprecedented loan application growth.